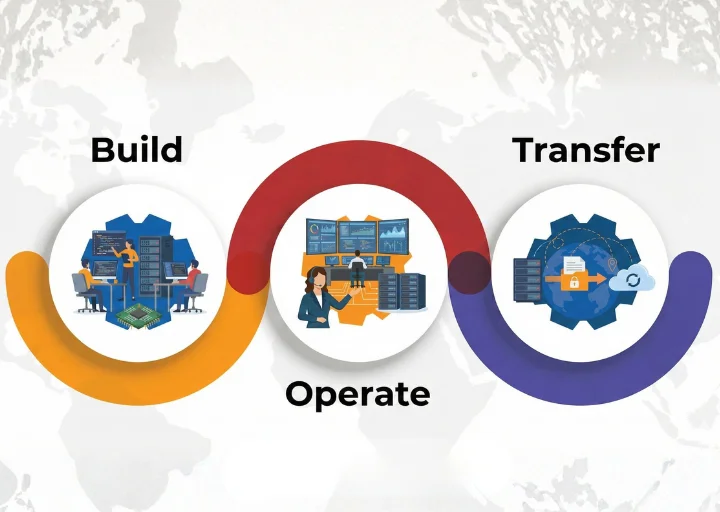

Vision alone does not usually succeed in major infrastructure and technology projects. They require capital, discipline in operations, and the capability of risk management over a long period of time. The build-operate-transfer (BOT) model can be considered an approach to such issues since it establishes an adequate framework according to which projects can be completely funded, designed, and operated by private companies and then transferred to their permanent owners. Through the allocation of duties between distinct stages, BOT fosters governments and organizations to achieve complex undertakings whilst remaining on budget and operationally sustainable.

In this model, the role of the involvement of the private sector is critical in the early execution. The specialized skills assist in effective construction, streamlining of operations, and optimization of performance so that assets are fully operational at the time of transfer. The critical elements of a successful BOT agreement over the long run are prudent planning, binding contracts, and a good fit of all parties concerned.

KEY TAKEAWAYS

- A build-operate-transfer (BOT) model enables private entities to finance, develop, and operate projects before transferring ownership to a public or private organization.

- BOT agreements help reduce financial exposure for governments and businesses while providing access to experienced construction and operations expertise.

- Ownership transfer follows a structured and contractual process, ensuring assets are optimized and operational at handover.

- BOT variations, including BOOT and BOO, provide flexible options for financing, ownership duration, and long-term asset management.

- Regulatory uncertainty, financing risks, and stakeholder coordination remain key challenges that require detailed contract planning and oversight.

What Is Build-Operate-Transfer?

Build-operate-transfer refers to a contractual buying-and-selling agreement whereby a private enterprise has the responsibility of designing, funding, building, and running a project within a prescribed duration. After that time has expired, it is handed over to a government or some other specified agency. Such a structure is typically used in relation to the development of infrastructure, outsourcing of technologies, and large-scale projects of the state or corporations in which long-term ownership is necessary but initial investment is difficult.

The BOT model reduces initial capital costs and transfers the operational and construction risks to the partners with experience. It is broadly applied in areas like transportation, energy, utilities, and information technology, and projects in these areas require large capital injections and technical expertise. The operational phase is an intermediate phase, and it is during this time that stabilization of the systems, processes, and teams can be experienced prior to a switch in ownership.

With the implementation of a BOT model, organizations can receive access to financial means and expertise without engaging in a direct capital investment. The model is advantageous to accelerate the delivery of the project, limit early risk exposure, and reinforce long-term strategic planning. The receiving entity takes over control of a proven asset after the transfer, in the absence of the complications normally involved during initial development.

How Build-Operate-Transfer Works

In a build-operate-transfer system, a privately held and operated project is handed over through assignment of financial, technological, and operational accountability to a governmental entity or other organization. This model is also very practical in those sectors where big projects are expected to be undertaken with great risk, sound financing, and sound working supervision.

The procedure starts with a written contract of responsibilities, schedules, and performance specifications. The individual partner invests and controls the construction, along with introducing the asset into operation. The mechanisms used to generate revenue during the operating period include service contracts, toll collection, and long-term usage contracts. These incomes help to cover the costs, with the possibility to help the operator improve performance and get rid of inefficiencies.

The ownership is passed within the agreed term upon the terms as indicated in the contract. The recipient acquires the ownership of a fully operational, revenue-generating property without necessarily incurring the initial stages of development risks. BOT structures aid in expanding the infrastructural base, enhance long-term forecasting of finances, and leave technical complexity to industry experts.

“A build-operate-transfer (BOT) model is a predictable method of developing both infrastructural and technological projects of high magnitude and strikes a balance between financial and operational risks.”

Variants of Build-Operate-Transfer

BOT frameworks can be adapted to meet varying project goals, funding mechanisms, and risk profiles. Each variation modifies ownership duration, operational control, and financial responsibility to suit stakeholder needs. Choosing the right structure depends on funding availability, long-term objectives, and risk management capacity.

Build-Own-Operate-Transfer (BOOT)

With a BOOT model, the ownership of the asset remains in the hands of the private entity until the stage of transfer, as the party that finances it, constructs it, and operates it. Service contracts, user fees, or structured payments are the means of investment recovery. The change of ownership will occur after the period of operation is over.

This method is typical of potentiating water plants, power plants, and toll roads. Long ownership enables operators to use the full raft of performance and efficiency to benefit by selling well in advance of when to the investor, which means greater long-term investment and reduced initial monetary strain on the public or receiving party.

Build-Own-Operate (BOO)

A BOO model gives the ownership of the private entity permanent and eliminates the transfer condition. The joint venture partner develops, funds, and manages the asset forever, whereby he/she earns via tariffs, service contracts, or long-term leases.

The structure is commonly employed in the energy production sector, telecommunications sector, and industrial infrastructure, with the ownership by the private sector associated with long-term operational objectives. The regulatory policing helps in quality assurance of their services, and governance is able to enjoy the benefits of the private investments without having to fund the investments directly.

Build-Lease-Transfer (BLT)

In a BLT arrangement, a private company constructs an asset and leases it to the intended user before ownership transfers. This model provides immediate access to facilities or services without requiring full upfront investment.

BLT agreements are common in public transport, healthcare infrastructure, and commercial developments. Lease payments help recover costs over time, and ownership transfers at the end of the lease period, supporting predictable long-term asset planning.

Build-Lease-Operate-Transfer (BLOT)

The BLOT model is an expansion of BLT, which incorporates operational responsibility throughout the lease period. The operation and maintenance are daily and under the control of the private entity, which is the one that leases the asset to the end customer.

This method is commonly applied in transport institutions, electricity plants, and infrastructures in the desire for general services. The transition is gradual, and performance assessment and refinement of operations can be done before a change of ownership.

The variations of BOT allow flexibility when it comes to structuring agreements according to funding capacity, operational requirements, and risk aversion. Revenue model and ownership goal consideration are factors that can be keenly observed, resulting in the formulation of scalable and sustainable infrastructure solutions.

Benefits of Build-Operate-Transfer

A BOT model is a viable model that provides an opportunity to give a smooth way of delivering big projects in a smooth way through control of financial and operational complexity. Companies, business owners, and the government rely on this strategy to reduce timelines, tap into expertise, and enhance cost-effectiveness.

BOT agreements allow organizations to reduce initial expenditures, reduce the delivery time, and have access to technical expertise.

- Lower financial risk: Private partners finance construction, reducing immediate capital demands.

- Faster project delivery: Experienced operators improve planning, execution, and risk control.

- Specialized expertise: Industry knowledge enhances quality, efficiency, and compliance.

- Reduced operational load: Early operations are managed by the private entity.

- Lifecycle cost efficiency: Maintenance and optimization occur before transfer.

- Flexible contract design: Agreements can be tailored to financial and strategic needs.

- Improved stakeholder coordination: Clearly defined terms align expectations and responsibilities.

BOT models balance risk allocation, expertise, and long-term ownership, enabling organizations to expand infrastructure and technology capabilities without absorbing early-stage complexity.

Examples of Build-Operate-Transfer

BOT agreements are widely used across industries where projects require significant capital and technical depth. This model allows essential infrastructure and services to be developed without transferring full risk to the eventual owner at the outset.

Transportation Infrastructure

Highways, metro systems, and airport facilities often rely on BOT contracts. Private partners handle development and operations while generating revenue through tolls or service agreements, before transferring ownership to public authorities.

Energy Projects

Solar, wind, hydroelectric, and conventional power plants frequently use BOT structures. Private operators finance and manage facilities under long-term contracts, supporting energy expansion without immediate public investment.

Water Treatment Facilities

Municipal water and wastewater systems benefit from BOT models by leveraging private funding and operational expertise. Communities receive compliant, fully operational systems after transfer without early financial strain.

Technology Outsourcing

BOT frameworks are widely applied in technology services, including development centers and IT operations. Private partners establish and manage facilities before ownership transitions, allowing organizations to scale capabilities while controlling risk.

Implementing Build-Operate-Transfer Models

Effective implementation of BOT requires planning, detailing of contracts, and managing the transition. The choice of partners will, in most cases, be done through competition based on the bid, financial capability, technical ability, and experience in operating.

During operation and construction, the private entity undertakes funding, implementation, maintenance, and monitoring of performance. Regular reviews are done to verify order adherence to contractual promotion standards. Transfer of ownership takes place after meeting the contractual conditions to provide the recipient with a stable, optimized asset.

Challenges Associated With Build-Operate-Transfer Model

Despite its advantages, the BOT model presents challenges that require proactive management:

- Complex contracts: Detailed legal and financial terms demand expert negotiation.

- High upfront investment: Private financing carries exposure if revenue projections fall short.

- Regulatory uncertainty: Policy or licensing changes may affect project viability.

- Operational risks: Construction quality and maintenance standards impact transfer outcomes.

- Coordination issues: Differing priorities between public and private stakeholders can cause friction.

- Handover complexity: Poorly planned transitions may disrupt operations.

- Long-term financial uncertainty: Market shifts and inflation can affect returns.

Addressing these risks through strong governance, transparent communication, and clear regulatory frameworks is essential for long-term success.

Public-Private Partnerships (PPP) vs Build-Operate-Transfer (BOT)

The major disparity between PPP and BOT models is the ownership term and the division of risks. BOT contracts give preference to ownership transfer upon expiry of a certain period of operation. PPP structures are normally characterized by long-term and working relationships and joint as well as continued partnership of the private sector.

PPP models are likely to be used in healthcare, education, and utilities, whereas BOT arrangements are mostly seen in transportation, energy, and infrastructure developments. The option here will be based on financial objectives, the desired ownership results, and the levels of acceptable risks.

Factors to Consider Before Choosing a Build-Operate-Transfer Model

Before selecting a BOT structure, organizations should evaluate:

- Project feasibility and funding needs

- Risk allocation and mitigation strategies

- Regulatory and legal requirements

- Operational capability and sustainability

- Revenue potential and return expectations

- Stakeholder coordination and governance

- Transfer planning and asset integration

Effective evaluation will make sure that it is consistent with financial plans, regulatory requirements, and long-term asset planning.

Infrastructure and technology investments that are long-term require strategies that manage the growth and control of risks. The build-operate-transfer model is a rigorous model that aids in the growth and reduces the challenges at an initial stage. Having the right planning, governance, and partnerships, BOT is still a powerful tool for delivering sustainable and high-impact projects in 2026 and beyond.